Environmental, social and governance (ESG) going mainstream

Date: April 2019

Environmental, Social and Governance (ESG) as a concept has gained wide currency in recent years. As the financial market attaches increasing importance to it, a growing number of companies also consider the inclusion of ESG factors into their operational principles an imperative. Such strategy helps build a better world, reduce damage to the environment and society, and create wonderful opportunities.

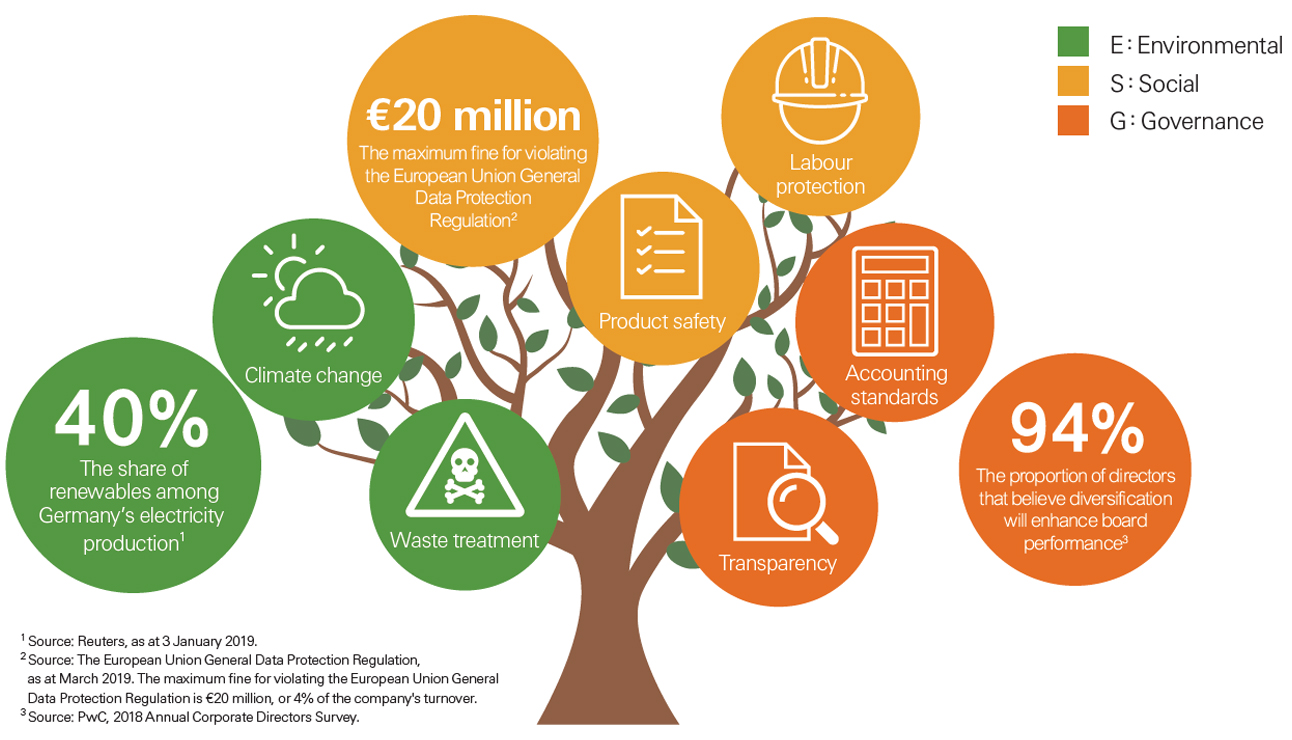

ESG violations

Profitability should not be the only thing that companies strive for. Social and environmental responsibilities are just as well important. Overlooking ESG factors not only threatens the supply chain, but also puts a company’s goodwill and stock prices at risk.

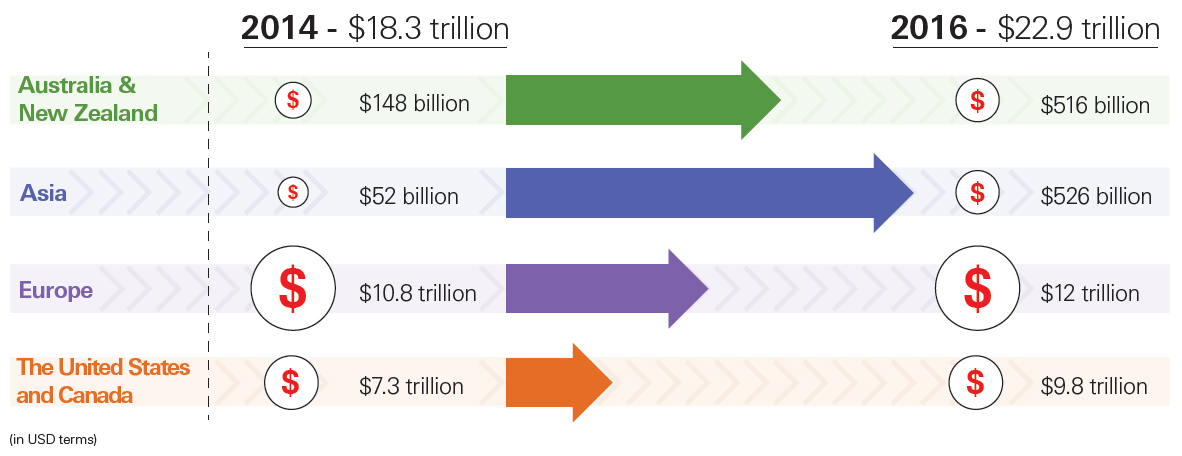

Exponential growth in socially responsible investments4

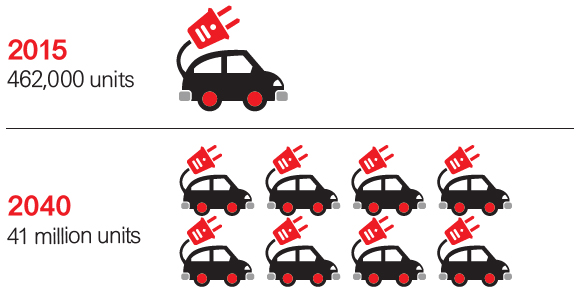

Sales of electric vehicles reach new highsDriven by environmental concerns and significant advancement in battery technology, sales of electric vehicles are expected to increase by 90 times between 2015 and 2040, and account for 35 per cent of total car sales5.

|

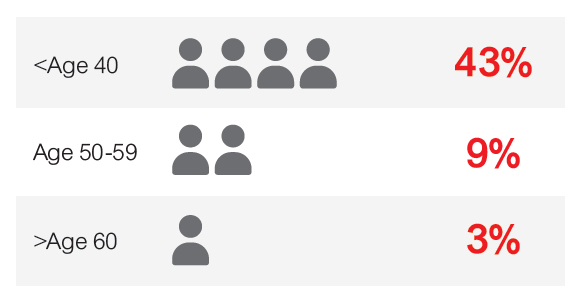

Millennials a big driving force behind ESGMillennials are concerned about environmental and social issues. Up to 43 per cent of the survey respondents aged 40 or below said that they had made relevant investments previously6.

|

4Source: Global Sustainable Investment Review, 2016.

5Source: BloombergNEF, 25 February 2016.

6Source: Barclays, 25 July 2018.

Lower - carbon investment opportunities shine

Companies with good ESG performance tend to have better corporate governance, and hence the advantage of long-term sustainability. Integrating ESG factors into the process of investing not only brings benefits to society, but also effectively manages risks, and creates opportunities for investors.

How does ESG investing work?7

Three advantages of lower-carbon investment strategies7Lower-carbon investing is an important aspect of ESG strategy.

|

|

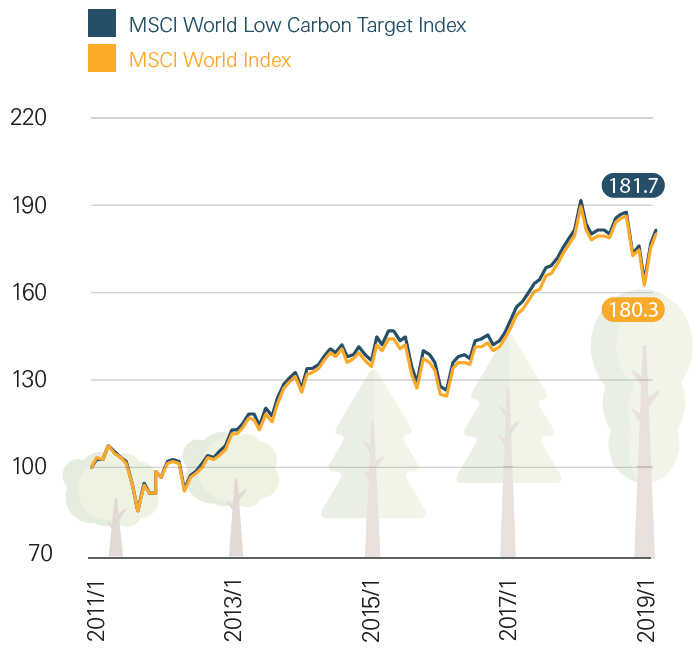

Applying lower-carbon strategies does not mean sacrificing investment returns8

|

7Source: HSBC Asset Management. For illustrative purposes only.

8Source: Bloomberg, HSBC Global Investment Management, net total return indices (in USD terms), as of end February 2019.

Investment involves risks. Past performance is not indicative of future performance.

This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. This page does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management (Malta) Limited accepts no liability for any failure to meet such forecast, projection or target. This page is based on information obtained from sources HSBC Asset Management reasonably believes to be reliable. However, neither HSBC Asset Management nor HSBC Asset Management (Malta) Limited do warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information.

Approved and issued by HSBC Asset Management (Malta) Ltd, Business Banking Centre, 80, Mill Street, Qormi QRM 3101, Company Reg No C20653 which is authorised to provide investment services by the Malta Financial Services Authority under the Investment Services Act.