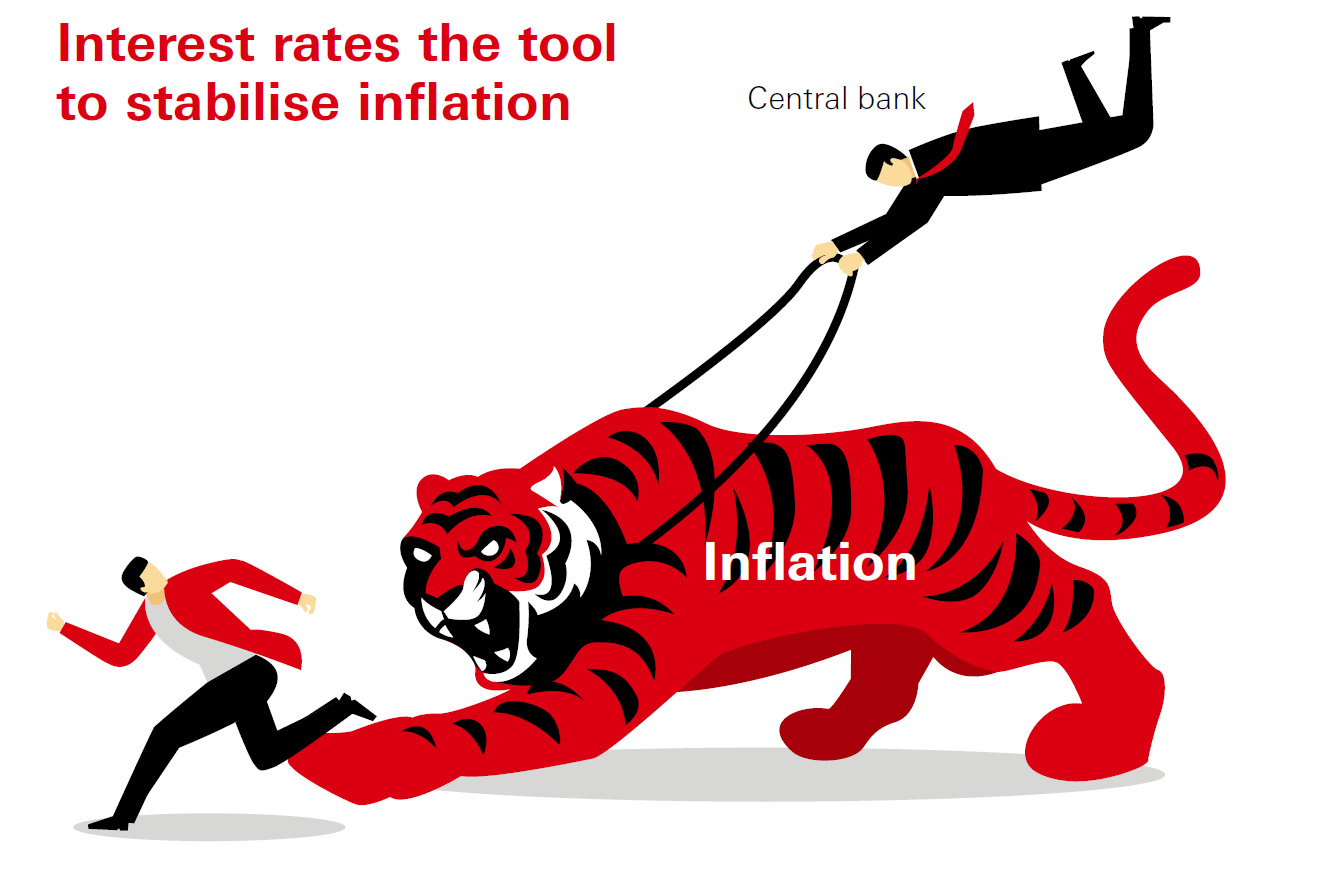

Interest rates and inflation are intimately related

Central banks adjust monetary policies to condition inflation levels

Have you thought about why a bowl of wonton noodles see such different prices between now and 40 years ago? That is the power of inflation. When the general price level rises persistently, the purchasing power of a currency falls. Mild inflation is conducive to economic development because consumers, expecting prices to continue to rise, prefer buying now than later to avoid the erosion of their purchasing power. Greater spending in turn encourages economic activities, creates employment and spurs investment. On the contrary, in times of deflation, consumers expect prices to fall and therefore defer spending.

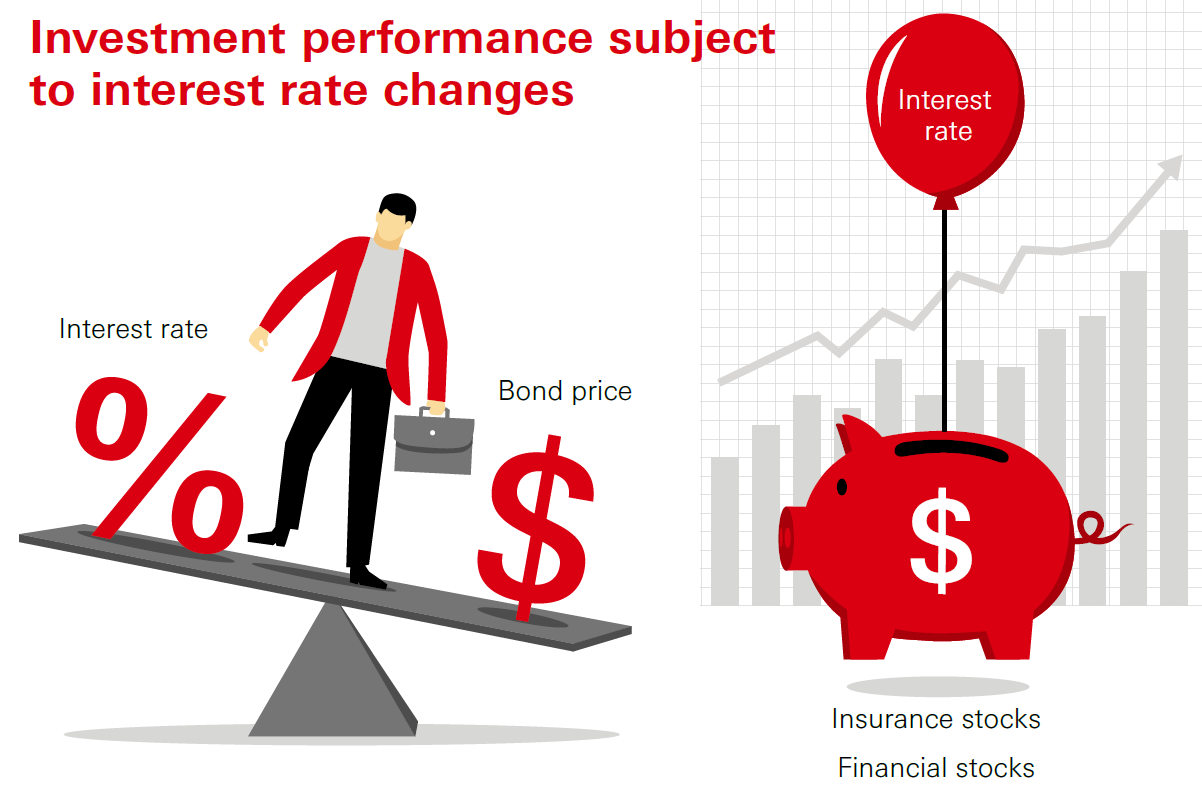

Interest rate is the cost of borrowing. It is closely related to inflation. To stabilise inflation, central banks tend to adjust interest rates from time to time to ensure the economy will not get overheated or shrink. If interest rate rises, meaning the cost of borrowing goes up, consumers will be more inclined to save than spend. Companies will also slow their investments. The decrease in demand will end up holding back economic growth and slow down inflation.